WHY DO COMPANIES NEED CPA AUDIT SERVICES IN CYPRUS?

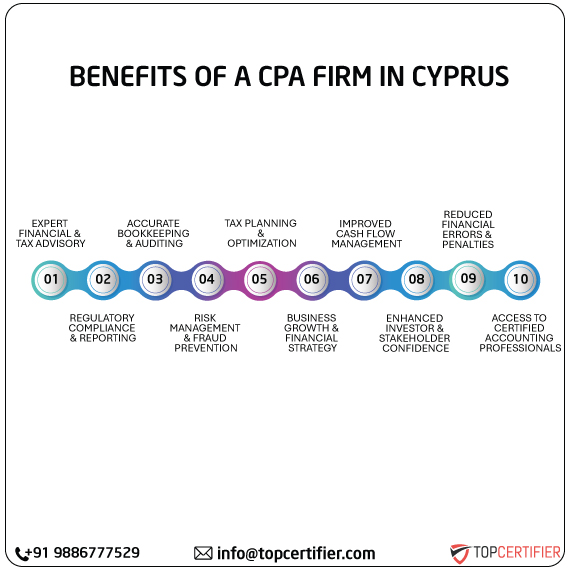

CPA audit services are becoming critical to ensure financial transparency, regulatory compliance, and operational efficiency in Famagusta, Larnaca and other major Cypriots cities. Organizations dealing with highly regulated sectors such as finance, healthcare, or manufacturing should have accurate financial records, controls against fraud, and compliance with national and international financial regulations to maintain their corporate credibility.

CPA audits bring companies in areas like Famagusta, Larnaca, Kyrenia, Limassol, Paphos, Morphou, Deryneia, and Nicosia, to ascertain financial risks, strengthen internal controls, and better the quality of financial reporting. It strengthens the controls and policies that guide the organization in relation to those financial decisions. It also ensures compliance with the accounting principles adopted in Cyprus, as well as with international principles such as IFRS, GAAP, and SOX regulations.

ESSENTIAL RESOURCES FOR ETHICAL TRADE & COMPLIANCE IN CYPRUS

Understanding CPA Audit Services in Cyprus

In audited financial reports, CPA audit services are significant for companies in Cyprus to provide assurance of financial integrity, regulatory compliance, and stakeholder trust. This involves an in-depth audit of financial statements performed by qualified professionals to verify and assess their accuracy and reliability.

Regulatory Bodies and Standards

Audit procedures in Cyprus are governed by agencies like the Ministry of Finance, Financial Services Authority, and Cypriots Institute of Certified Public Accountants (IAPI). These organizations guarantee that CPA audits follow the national accounting standards, the PSAK, and ethical standards.

Types of CPA Audit Services

There are several types of audit services provided based on the needs of a business, including statutory audits, which are required by law; internal audits for evaluating internal control systems; compliance audits to fulfill regulatory requirements; and forensic audits for the investigation of fraudulent activities or irregularities.

Key Audit Firms and Service Providers

In Cyprus, international and national CPA firms operate. International firms such as Deloitte, PwC, EY, and KPMG provide a broad range of services alongside local firms of repute well versed in local business practice and regulatory frameworks.

Audit Process and Reporting

The audit process typically involves three stages: planning, fieldwork, and reporting. During this process, auditors assess risk, gather evidence, test financial records, and ultimately issue an audit opinion—ranging from unqualified to adverse—based on their findings.

Resource and Selecting the Right CPA Firm

Essential resources for understanding audits include the official websites of IAPI, OJK, and IAI, which publish regulations, standards, and guidance. Companies should consider the accreditation, experience, transparency, and knowledge of the industry in selecting a CPA firm.

CPA AUDIT SERVICE BY THE BEST COMPLIANCE CONSULTANT IN CYPRUS

TopCertifier, is the best CPA audit consultant, offers financial audit solutions as a complete package for providing financial transparency, regulatory compliance, and risk management to businesses. They include:

We outline financial reporting frameworks with compliance gaps through analysis and suggest remedial measures in alignment with industry standards to improve financial transparency and regulatory adherence and strengthen the reporting.

We have in place different audits of detailed reviews to ensure conformity to standards by way of verification of the statements, that is, GAAP, IFRS, and others of the misrepresentation so as to improve corporate governance on financial matters.

Estimate the internal control system and risk management adopted in the organization with their performance based on the identification of fraud risk and improvement of financial governance and compliance with all the global financial regulations.

We offer attestation services that will ensure SOX, SSAE 18, ISAE 3402, and local standards compliance to augment financial integrity, accountability, and transparency.

Train teams in financial auditing, risk management, and regulatory compliance, and equip professionals with essential skills to maintain oversight and accuracy in financial reporting.

We carry out CPA audits and continuously maintain managed services for financial oversight to ensure accurate reporting and fraud prevention in compliance with global audit standards.

They are the first step in the preparation of professionals towards CPA audits, where they will learn how to execute the audit feature in terms of regulations and the best practices that will help realize compliance towards the financial standards and governance policy.

Trust Us To Lead The Way In Certification And Compliance

Knowledge And Expertise

Thorough Understanding Of The Framework, Its Requirements, And Best Practices For Implementation

Proven Track Record

Successful Track Record Of Helping Clients Achieve Compliance, With Positive Client Testimonials And Case Studies.

Strong Project Management Skills

Ensure The Compliance Engagement Runs Smoothly And Is Completed On Time And Within Budget.

Experienced Team

Possession Of Experienced Professionals, Including Auditors, Consultants, And Technical Experts

Exceptional Customer Service

Committed To Excellent Customer Service With Clear Communication, Responsive Support, And A Focus On Satisfaction.

Competitive Pricing

We Prioritize Delivering High-Quality Services With Competitive Pricing That Provides Exceptional Value To Our Clients

FAQs

FREQUENTLY ASKED

The audit service provided by CPAs may be described as an in-depth examination by an independent reviewer of financial statements, internal controls, and compliance to promote accuracy, transparency, and adherence to GAAP and IFRS and Cypriots financial regulations.

CPA audits entail offering financial credibility, fraud checks, and compliance services in accordance with the international and Cypriots tax and financial reporting regulations, thereby improving investor and stakeholder confidence.

Internationally, the classification of CPA audits includes financial audit, compliance audit, operation audit, and forensic audit; namely, these four classifications are distinguished depending on the nature of concern in the area of financial governance while applying for Cyprus.

CPA audits consider financial records, internal controls, and tax compliance with the laws such as GAAP, IFRS, SOX, and Cypriots tax laws (like PP No. 23/2018 and UU No. 36/2008) and identify financial risks.

CPA audits are required in Cyprus by corporations, financial institutions, government agencies, and businesses, especially those involved in foreign investment, banking, and public trading.

On account of this, in Cyprus, publicly listed organizations are required to conduct a yearly financial audit, and private companies should conduct audits on account of their tax obligations and also in terms of business exigencies.

Important documents include financial statements, tax files, payroll, business contracts, and compliance policy descriptions for adhering to Cypriots Financial Accounting Standards.

The timeline varies based on different sizes and complexities, subject to the nature of the industry and the regulatory requirements set in Cyprus.

Public companies must conduct annual audits. Private companies may need auThe auditor will report any discrepancies, risks, and recommendations for improving financial reporting to ensure compliance with Cypriots financial law.

Businesses should keep accurate financial records, adhere to tax laws (PPN, PPh, BPJS), and institute robust internal controls to minimize financial discrepancies arising.